- Only 5% of the buyer’s journey is with a salesperson, Gartner

- Email response rates have declined by 30%, according to HubSpot;

- 68% of organisations reported missing their sales targets in July 2022 (Pavilion),

The big-picture problems for B2B sellers include

- More and more people added to buying committees,

- Increasing turnover of decision-makers from the buying committees,

- An inability to unite the buying committee around a cause that is bigger than just your products and services,

- It results in longer deal cycles, lower win rates, weaker pipelines, and frustrated sellers and buyers.

The big change

LinkedIn data shows that top-performing social sellers spend 10% less time selling than the average B2B sales performer.

What’s the secret?

These top-performing social sellers are

- Incredibly strategic with their time,

- Highly skilled at uncovering relevant data points,

- Significantly more time researching and understanding their potential ideal buyers,

- Mapping key relationships on buying committees often to second connections,

- Capitalising on the most opportune moments for personalised outreach – communicating just-in-time approach,

This approach—called deep sales—is positioned to shrink the buyer-seller gap by giving sellers the best tools on what to focus on for the highest probability of selling more.

But shifting the revenue performance curve starts earlier.

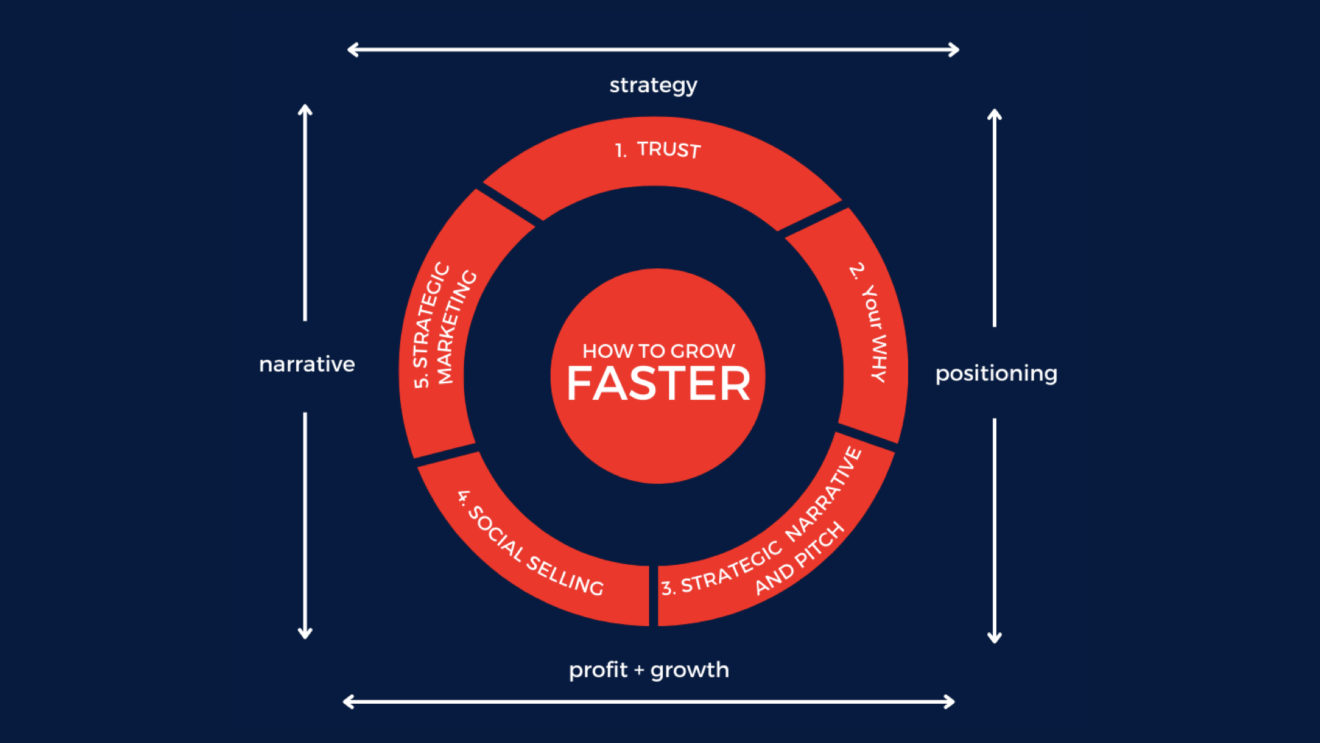

Stage one – Fix first,

- Fix your value proposition – your WHY

- Fix your pitch and narrative to stand up and rise above the noise of the market,

- Fix and improve your business’s trustability, credibility and purpose,

Selling newspaper subscriptions is hard work. Every newspaper reports the news – local, national and international. News is everywhere, on every digital channel, and it’s mostly free.

Finding your WHY – why should your ideal buyers buy only from your newspaper rather than competitors?

Why should they pay a premium price?

The New York Times is a great case study – its physical papers, digital subscriptions and upsells – all went boom – when they found their WHY.

Their sales pitch and strategic narrative sang the story with enormous impact, and revenue lifted significantly for years. It powered their culture, HR, stakeholders – everyone.

The Truth is hard to find,

The Truth is hard to understand,

The Truth is hard to know,

Truth – The New York Times.

First – fix stage one – remove the breaks in your business.

Take this ten-minute professional quiz to test, find and fix the gaps in your business. It scores your business against how the best of 400,000 plus businesses grew fastest from across 47 countries over ten years.

It is free – you get your custom gap analysis and growth blueprint based on your scores.

Stage two –

- Implement a proven social selling methodology,

- Implement a proven omnichannel seller strategy – the average is now 15 plus channels – including email, in-person, social outbound, Adwords, Retargeting and many others,

It automates many steps that set the top performers apart.

The scientific approach to acquiring B2B customers essentially automates your buyer acquisition with data-driven experiments, making failure impossible.

- Account insights: Targeting accounts that have the best chance of success

- Relationship intelligence: Identifying decision makers and finding the best path to reach them

- Buyer intent: Capitalising on the right moments to reach out based on signals such as organisational growth, job changes, and change in strategy,

With an unparalleled ability to use automated data and insights to drive outcomes, the deep-sales approach provides the sales team with more time to unlock opportunities – with real decision-makers.

It’s an approach that leads to faster deal cycles, higher win rates, and revenue growth: a seismic shift in the evolution of B2B selling.

As Mckinsey reports – The more omnichannel a sales organisation deploys, the bigger the market share gains.